Legislator Abbott Says Niagara County Readjusts Income Guidelines for County Property Tax Exemptions for Seniors, People with Disabilities

Niagara County Legislator Rick Abbott today said the Niagara County Legislature has passed two local laws to readjust the income guidelines for county property tax exemptions for seniors (65+) and people with disabilities so more people can take advantage of the program and those who are receiving the exemption do not lose them.

“The income guidelines have not been increased since 2016, which means fewer seniors and people with disabilities are able to participate,” said Abbott, who sponsored the local law. “Plus, inflation has led to increased monthly Social Security payments, which, while a good thing for these folks, also means many would receive a lower property tax exemption or lose it completely.”

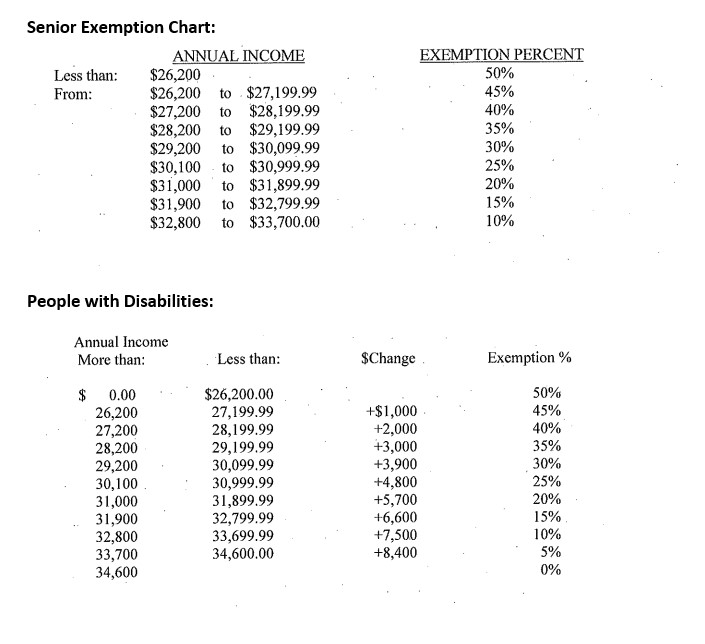

Abbott said under the old guidelines, seniors making less than $21,000 received a 50 percent exemption on county taxes; that is now increased to $26,200. At the upper end, to receive a 10 percent exemption, the top income was $28,500; that now increases to $33,700. Any income over that does not receive an exemption. There are nine different percentage levels of exemption between the low and top income.

For the disability exemption, the lowest level for a 50 percent exemption was $15,025; that is now increased to $26,200, like the senior exemption. The upper limit was $23,425 for a five percent exemption; that now increases to $34,600. There are 10 different percentage levels of exemption between the low and top income.

“These exemptions are really about trying to help keep seniors and those with disabilities in their homes where many raised their families, served our community and have been the bedrock of neighborhoods for decades,” said Abbott.

Those who have questions about their exemption are encouraged to call their town/city assessor. Those with general questions about how the exemptions work can contact the Niagara County Department of Real Taxation at (716) 439-7077.